Unlocking Big Data Insights with Azure Synapse: A Real-Life Client Success Story

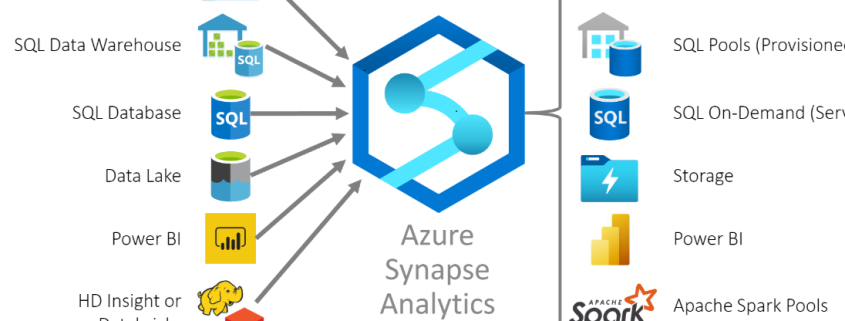

In the era of big data, businesses need robust solutions to handle large datasets, integrate diverse data sources, and perform complex analytics. Azure Synapse Analytics, a limitless analytics service, combines big data and data warehousing in a single platform to deliver fast, actionable insights. In this blog, we’ll showcase how we helped a financial services client leverage Azure Synapse to streamline data processing, enhance customer insights, and optimize risk assessment, empowering them with a scalable, high-performance analytics solution.

Client Background and Business Challenges

Our client, a large financial institution, manages massive datasets from multiple sources, including customer transactions, credit scoring, risk assessments, and compliance data. The institution’s existing data environment faced the following challenges:

- Data Silos: Data resided in various on-premises systems and third-party data warehouses, making integration and analysis difficult.

- Performance Bottlenecks: The organization struggled with processing large datasets quickly, especially for real-time reporting and decision-making.

- High Maintenance Costs: Managing multiple databases and ETL tools was costly and complex.

- Compliance and Security: As a financial institution, data security and compliance with regulatory standards were paramount.

To address these challenges, we proposed a centralized analytics solution with Azure Synapse Analytics to consolidate data storage, improve processing speeds, and enable robust analytics and machine learning.

Solution Overview: Implementing Azure Synapse Analytics

Azure Synapse provided a unified analytics platform that allowed our client to ingest, prepare, manage, and serve data for business intelligence and machine learning. Here’s how we implemented Synapse for a seamless and scalable analytics experience:

1. Centralized Data Storage with Synapse and Azure Data Lake Storage (ADLS)

- Challenge: The client had data stored in various on-premises databases, cloud storage solutions, and third-party data sources, creating data silos.

- Solution: We used Azure Data Lake Storage (ADLS) as the central repository within the Synapse environment. All data, including customer records, transaction histories, and credit scores, was ingested into ADLS.

Integration with Synapse: Azure Synapse seamlessly connected to ADLS, enabling the client to perform high-speed analytics on large datasets directly within Synapse without duplicating data.

2. Data Ingestion and ETL Automation with Synapse Pipelines

- Challenge: The client’s legacy ETL processes were slow and costly to maintain.

- Solution: Using Azure Synapse Pipelines, we built automated ETL workflows that ingested data from various sources (SQL Server, third-party APIs, and CRM systems) into Synapse. Data was regularly refreshed to ensure that analytics operated on the most recent data.

With Synapse Pipelines, we streamlined data ingestion, scheduling, and transformation tasks, significantly reducing ETL processing time. This automation allowed the client to eliminate dependency on multiple ETL tools and reduce costs.

3. Data Processing and Analytics with Apache Spark and SQL Pools

- Challenge: Processing large datasets for real-time reporting was slow and resource-intensive.

- Solution: Azure Synapse offers dedicated SQL pools for data warehousing and Apache Spark pools for big data processing, which allowed us to optimize for different types of workloads.

We used SQL pools to perform fast, on-demand SQL queries on structured data (e.g., customer profiles and transaction history), while Spark pools handled unstructured data like customer behavior logs and social media sentiment analysis. Combining these two capabilities in Synapse enabled the client to run complex queries and produce analytics results in seconds.

4. Enhanced Data Security and Compliance

- Challenge: As a financial institution, the client required strict compliance with data protection standards.

- Solution: Azure Synapse provides enterprise-grade security features, including row-level security, column-level encryption, and integration with Azure Active Directory for access control. We implemented these measures to ensure only authorized personnel could access sensitive customer and financial data.

Synapse’s built-in compliance with financial standards such as GDPR and PCI-DSS provided an extra layer of assurance, simplifying the client’s compliance management.

5. Building Real-Time Analytics and Customer Insights Dashboards

- Challenge: The client needed real-time insights into customer transactions, risk levels, and creditworthiness for personalized customer service.

- Solution: We created real-time dashboards in Power BI using data from Synapse. Data in Synapse was processed and updated in real time, then streamed to Power BI to generate insights such as:

- Customer Segmentation: Grouping customers based on financial profiles and behaviors for targeted offers.

- Credit Risk Analysis: Assessing credit risk for new applicants and monitoring ongoing risks for existing customers.

- Fraud Detection: Tracking suspicious transactions in real time and alerting the compliance team when anomalies were detected.

The client’s team now had easy access to real-time customer and transaction data, helping them make data-driven decisions on customer engagement and risk mitigation.

Example Use Case: Automated Credit Scoring with Machine Learning

One of the primary goals was to automate and improve the credit scoring process. Here’s how we achieved this using Azure Synapse and machine learning:

- Data Preparation: Using data from Synapse, we prepared historical transaction data, repayment history, and demographic information. Synapse’s Spark capabilities allowed us to quickly clean and preprocess the data.

- Model Training: We trained a credit scoring model using Azure Machine Learning and integrated it within Synapse for continuous learning. The model was designed to predict creditworthiness, identifying high-risk customers based on historical patterns.

- Real-Time Scoring: After deployment, the model ran within Synapse to provide real-time credit scores. When a new customer applied for credit, the model instantly generated a credit score, allowing the client to make swift, data-informed decisions.

- Continuous Model Improvement: Using Synapse Pipelines, the client could retrain the model monthly with the latest data, ensuring its accuracy remained high.

Outcome: By automating the credit scoring process, the client saw a 30% reduction in loan approval time and a more accurate assessment of credit risk, reducing defaults and improving profitability.

Technical Highlights of the Azure Synapse Solution

- Unified Analytics Platform: Synapse consolidated data engineering, machine learning, and analytics in a single platform, simplifying the data pipeline and reducing operational overhead.

- Scalability and Performance: Synapse’s on-demand resource scaling allowed the client to handle peak data loads efficiently, ensuring smooth operations even during high-demand periods.

- Integrated Security and Compliance: Synapse’s security and compliance features met the client’s strict regulatory requirements, safeguarding customer data.

- Seamless Power BI Integration: With real-time dashboards in Power BI, the client’s management team gained timely insights, improving their ability to respond to changing market conditions and customer needs.

- Reduced Costs: The client eliminated the need for separate ETL, data warehousing, and reporting solutions, resulting in significant cost savings.

Results and Business Impact

After implementing Azure Synapse Analytics, the client experienced significant improvements in data processing, reporting speed, and decision-making capabilities:

- Reduced Processing Time: Queries that once took hours were now completed within minutes, accelerating the client’s ability to make informed decisions.

- Improved Customer Insights: Real-time insights enabled the client to personalize offers, improve customer satisfaction, and build stronger relationships with their customer base.

- Enhanced Risk Management: The automated credit scoring and fraud detection processes provided more accurate risk assessments, reducing the institution’s overall risk exposure.

- Operational Efficiency: The single-platform solution simplified their data infrastructure and reduced maintenance costs, freeing up resources for innovation.

Conclusion: Transforming Financial Analytics with Azure Synapse

Azure Synapse Analytics transformed the client’s data infrastructure, allowing them to break down data silos, accelerate analytics, and enhance customer engagement. By integrating Synapse with ADLS, Power BI, and machine learning, the client achieved a unified, high-performance analytics platform that was both scalable and secure.

If your organization faces similar challenges in managing and analyzing large datasets, Azure Synapse offers a powerful, flexible solution that can drive data-driven success.

Leave a Reply

Want to join the discussion?Feel free to contribute!